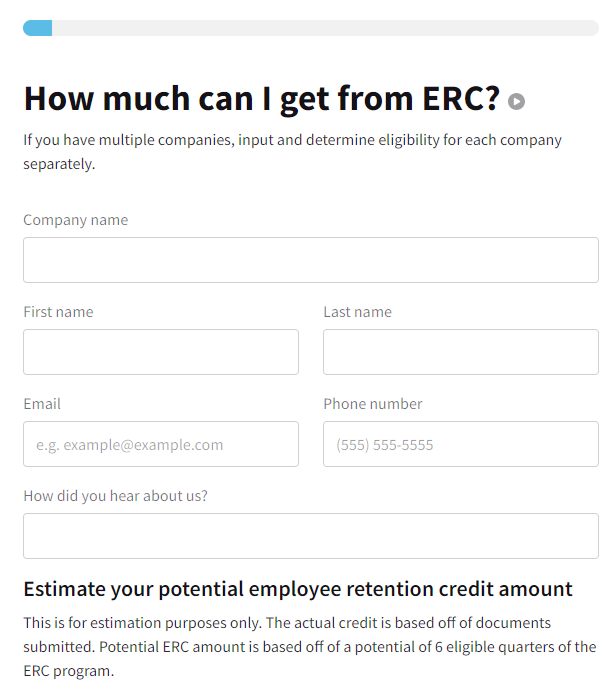

You’re ready to maximize your Employee Retention Credit (ERC), and we’re here to help. Whether you’re a small business or a large corporation, our guide will simplify this complex process for you.

You’ll learn the criteria, wage qualifications, and calculation methods, ensuring you get every penny you deserve.

Let’s dive into the world of ERC and make this federal tax credit work for you.

EMPLOYEE RETENTION TAX CREDIT (ERTC)

In understanding the Employee Retention Tax Credit (ERTC), you’ll discover it’s a refundable tax credit designed to encourage businesses, like yours, to continue paying employees during pandemic-related financial hardships. The ERTC is applicable from March 13, 2020, through September 30, 2021. Even if your company received Paycheck Protection Program (PPP) loans, you’re still eligible for this credit.

To qualify, you need to meet certain criteria. First, your business operations must have been full or partially suspended due to COVID-19 related governmental orders. Or, you should have a significant decline in quarterly gross revenue compared to 2019.

The credit calculation differs for 2020 and 2021. For 2020, the credit is 50% of qualified wages paid, up to $10,000 per eligible employee, providing a maximum credit of $5,000 per eligible employee. In 2021, the credit increases to 70% of qualified wages paid, up to $10,000 per eligible employee per quarter, offering a maximum credit of $7,000 per eligible employee per quarter.

When determining eligible wages, consider the different date ranges for the CARES Act, the Consolidated Appropriations Act, the American Rescue Plan Act, and the Recovery Startup Business.

HOW IS EMPLOYEE RETENTION TAX CREDIT (ERTC) CALCULATED?

Calculating the Employee Retention Tax Credit (ERTC) depends on the relevant year.

For 2020, you’ll determine the ERTC by taking 50% of qualified wages paid, capped at $10,000 per eligible employee.

However, for 2021, the calculation changes to 70% of qualified wages paid, with a cap of $10,000 per eligible employee per quarter.

2020 ERTC CALCULATION

You’ll find that calculating your Employee Retention Tax Credit (ERTC) involves determining your business’s eligibility, identifying qualifying wages, and following the correct filing procedures.

Start by assessing your eligibility based on financial setbacks and compliance with employee count restrictions.

Next, identify qualifying wages, including all FICA wages and employer-paid health plan expenses. Remember, the cap for these is $10,000 per employee per quarter. For 2021, calculate 70% of these eligible wages for each quarter. The maximum credit per employee per quarter is $7,000.

File a 941-X for each quarter you’re claiming the credit and adhere to the three-year filing time constraint.

Strategic and meticulous filing ensures you receive the ERTC you’re entitled to.

2021 ERTC CALCULATION

As an employer, it’s essential to understand how the Employee Retention Tax Credit (ERTC) is calculated, and the first step involves identifying the eligible wages for each of your employees.

- Determine Eligible Wages: This includes all wages and healthcare paid to employees from Jan 1 to Sep 30, 2021, capped at $10,000 per employee per quarter.

- Calculate the ERTC: For 2021, ERTC is computed at 70% of eligible wages per quarter. This means a maximum credit of $7,000 per employee per quarter.

- Maximize Credit: The total credit per employee for the first three quarters of 2021 is $21,000.

- Eligibility: For employers with less than 500 full-time employees in 2019, the credit is available for all employees receiving wages in 2021.

HOW TO CALCULATE ERC CREDIT WITH PPP

To figure out your Employee Retention Credit (ERC) with the Paycheck Protection Program (PPP), you need to carefully separate your employees’ qualifying wages that weren’t covered by PPP funds and meet the ERC’s eligibility requirements. This process involves strategic and detailed calculations to ensure accuracy and maximize your credit.

First, note that you can claim ERC for employees numbering no more than 100 in 2020 and no more than 500 in 2021. This headcount includes all full-time workers, irrespective of whether they were paid with PPP funds or not.

Next, consider eligible FICA wages. These include the qualifying wages you paid to your employees, which can also encompass employer-covered health insurance premiums. But remember, any wages covered by PPP funds aren’t eligible for the ERC calculation.

Now, calculating your ERC involves determining the qualifying wages that weren’t paid with PPP funds. For 2020, this is 50% of qualifying wages paid, up to $10,000 per employee, giving you a maximum credit of $5,000 per employee. However, for 2021, the credit rate is 70% of qualifying wages paid, up to $10,000 per eligible employee per quarter, maxing the credit at $7,000 per employee per quarter.

The trick to maximizing the benefits of both PPP and ERC lies in careful accounting and strategic allocation of PPP funds. By accurately separating your wages and meeting eligibility requirements, you can take full advantage of the financial relief these programs provide. Remember, precision and timeliness in filing are crucial for claiming your ERC.

ERC CREDIT CALCULATION: TIPS AND TRICKS

To maximize your Employee Retention Credit, it’s vital to be strategic and detail-oriented in your approach.

Don’t overlook opportunities such as including part-time employees in your calculations and keeping on top of the rolling deadlines for submissions.

Also, remember to consider the potential benefits of the work opportunity tax credit in your overall financial planning.

Don’t miss out

Don’t let the complexity of the Employee Retention Credit calculation deter you from maximizing your company’s benefits; here are some tips and tricks to guide you through the process.

- Understand the criteria: Your business must meet certain financial setbacks or have operations suspended due to government mandates.

- Count your employees: You qualify for the credit if you employ less than 500 individuals.

- Know your wages: All FICA wages and health plan expenses paid by the employer count towards the credit.

- File correctly: Ensure you file a 941 for each quarter when seeking the credit.

Don’t forget your part-time employees

While you’re calculating your ERC, remember that even though your part-time employees aren’t included in the overall employee count for qualification, you can still include their wages in your credit calculation. This strategic move increases your credit without impacting your eligibility.

Be meticulous in determining their qualifying wages, which encompass all FICA wages and employer-paid health plan expenses. The cap is at $10,000 per employee per quarter, so plan accordingly.

When filing your 941 for each quarter, ensure you’ve included part-time wages to maximize your credit.

Diligence in this process can lead to substantial savings. Don’t overlook your part-time staff; their inclusion in the ERC calculation can make a significant difference to your business’s financial health.

Remember that applicable deadlines are rolling

In your journey through the ERC credit calculation, it’s crucial to keep in mind that the deadlines for each quarter are on a rolling basis, constantly moving forward. This means that you must stay vigilant and organized to ensure you don’t miss out on any potential credit.

Here are some key points to remember:

- The deadline for Q1 2020 has already passed. You can’t claim ERC for this period.

- Deadlines for subsequent quarters are: Q2 – July 31, 2023, Q3 – October 31, 2023, and Q4 – January 31, 2024.

- Timely filing is critical for eligibility. Employers must file a 941-X before each quarter’s due date.

- Missing the deadlines can result in losing eligibility for the credit.

Be mindful of the work opportunity tax credit

As you navigate your company’s ERC credit calculation, remember that if any of your employees qualify you for the work opportunity tax credit, you can’t include those employees in your calculation. This is one of the federal tax rules that can trip you up. Be analytical in your approach to avoid this pitfall.

Strategize by identifying which employees qualify for which credit. Remember, double-dipping isn’t allowed. You need to make a choice between the two credits for each employee. This is a detail-oriented task that requires precision.

Every employee counts when calculating your credit, so it’s crucial to get it right. A strategic, accurate approach to your ERC credit calculation can significantly benefit your company’s financial health.

Here are the Top 5 Ways to Calculate the Employee Retention Tax Credit

Calculating the Employee Retention Tax Credit can seem daunting, but you’re about to become a pro.

We’re going to cover the top 5 methods you can use to accurately calculate your credit.

From understanding employee and wage qualifications to crucial filing deadlines, we’ve got you covered.

How to Calculate Employee Retention Credit?

You’ve got five main methods to work out your Employee Retention Tax Credit, so let’s dive into each one.

- Eligibility Determination: Understand the eligibility criteria for both the years 2020 and 2021. Ensure you meet financial setback criteria and have less than 500 employees.

- Wage Identification: Calculate the total qualifying wages for the employee retention credit. Remember, it’s capped at $10,000 per employee per quarter.

- Credit Calculation: In 2020, the credit was 50% of eligible wages. In 2021, it increased to 70%. Do the math accordingly.

- Filing: File a Form 941-X for each quarter, adhering to the respective deadlines.

Employee Retention Credit Calculation

Diving into the specifics of Employee Retention Credit calculation, it’s crucial for you to understand, and subsequently apply, these top 5 methods for an accurate and beneficial result.

1) Identify qualifying events: Determine if your business experienced a shutdown order or a significant decline in gross receipts.

2) Calculate eligible wages: For 2020, include up to $10,000 in wages per employee. For 2021, you can factor in $10,000 per quarter.

3) Apply the credit percentage: Use 50% for 2020 and 70% for 2021.

4) Determine the maximum credit: It’s $5,000 per employee for 2020 and $7,000 per quarter in 2021.

5) Complete your paperwork: File Form 941, Employer’s Quarterly Federal Tax Return.

Understanding these methods will help maximize your Employee Retention Credit.

Employee Retention Credit ERC Calculation

By understanding and implementing these top five methods, you’ll be able to accurately calculate the Employee Retention Credit and maximize your potential tax benefits.

- Gross Receipts Test: Compare your quarterly gross receipts from 2021 to those from 2019. If your 2021 receipts are less than 80% of what they were in 2019, you qualify for the ERC 2021 program.

- Employee Count: Make sure your business has fewer than 500 employees.

- Credit Calculation: For each quarter, calculate 70% of eligible wages, capped at $10,000 per employee per quarter.

- Filing: File a Form 941 for each quarter to claim the credit, and ensure to do so within the three-year filing period.

Approach these calculations strategically and consult with your accountant for precise results.

How To Calculate Employee Retention Credit 2021?

Let’s break down the top five ways you can calculate the Employee Retention Credit for 2021, ensuring you get the maximum possible tax benefit.

- Determine Eligibility: To qualify, you must meet specific criteria such as experiencing a significant decline in gross receipts or having business operations suspended due to government mandates.

- Identify Qualifying Employees: Generally, you must employ fewer than 500 people and file a 941 for each quarter to seek the credit.

- Calculate Qualifying Wages: Include all FICA wages and consider health plan expenses paid by you as qualifying wages.

- Calculate the Credit: For each eligible employee, you can claim a credit of 70% on up to $10,000 of qualifying wages per quarter.

- File Correctly: File a 941-X for each quarter and adhere to deadlines to claim the credit.

What Wages Qualify When I Calculate The Employee Retention Credit?

When you’re crunching the numbers for the Employee Retention Credit, you’ll need to know which wages qualify and how to calculate them accurately. Understanding the qualifications and calculations is crucial to maximizing your credit.

Here are the top 4 ways to determine qualifying wages:

- Consider all wages and compensation that are subject to FICA taxes as qualifying.

- Include qualified health expenses. These can be calculated in several ways depending on circumstances, but they generally include both the employer and employee’s pre-tax portions.

- Only include wages paid after March 12, 2020, and through September 30, 2021.

- Exclude any wages that are forgiven or expected to be forgiven under the Paycheck Protection Program.

How to Calculate the Employee Retention Credit in 2022?

You’ll need to understand several important factors to accurately calculate the Employee Retention Credit for your business in 2022. Start by determining your eligibility. If your operations were fully or partially suspended by a governmental authority, or if you experienced a significant decline in gross receipts, you might qualify. The decline must at least be 20% in 2021 compared to 2019.

Once eligibility is established, identify qualified wages. These include all FICA wages and health plan expenses paid by you, the employer. Bear in mind that the cap is $10,000 per employee per quarter.

Next, calculate the credit. For 2021, it’s 70% of qualified wages paid, up to $10,000 per employee, per quarter, which means the maximum credit is $7,000 per employee per quarter.

Finally, file your claim. You’ll need to file a 941-X for each quarter you’re claiming the credit. Keep in mind that deadlines are crucial. For the second, third, and fourth quarters of 2021, the deadlines are July 31, 2023, October 31, 2023, and January 31, 2024, respectively.

Before you file, consider consulting with a professional ERC Consultant. They can guide you through the process and help you claim up to a $26,000 refund per employee for 2020 and 2021. Remember, you have three years to file an amended IRS Form 941-X to claim this credit. This strategic approach will help you maximize your Employee Retention Credit in 2022.

Conclusion

Navigating the ERC process isn’t easy, but with strategic planning and attention to detail, you can maximize your credit. Remember, whether you’re a small business or large corporation, understanding the qualifying criteria and calculation methods is crucial.

Keep our tips and tricks handy for a smooth calculation process. Ensure you’re not leaving any money on the table in 2022. Now’s the time to leverage the Employee Retention Credit and navigate your business towards financial stability.

Hello! Would you mind if I share your blog with my myspace group?

There’s a lot of folks that I think would really appreciate your content.

Please let me know. Many thanks

Hi, I thought I already replied to this. yes you can share the blog, however, ERTC is essentially over. Please see the top post on this website with the update.