You’re navigating the tough road of business ownership during a pandemic. You’ve heard of the Employee Retention Tax Credit (ERTC), but are you eligible? It’s a vital question.

The ERTC can offer up to $26,000 per employee. But understanding its ins and outs isn’t easy. Don’t worry – this article’s here to help. It’ll guide you through the complexity of ERTC eligibility, helping you figure out if your business can benefit.

Stick around, it’s about to get clearer.

What is the Employee Retention Tax Credit?

The Employee Retention Tax Credit, or ERTC, is your business’s opportunity to claim significant tax relief if it met certain conditions during the COVID-19 pandemic. Instituted as part of the CARES Act in March 2020, the ERTC aimed to provide financial relief to businesses and tax-exempt organizations affected by the pandemic. The credit is calculated based on the payment of certain employment taxes to eligible employees during specific quarters of 2020 and 2021.

To qualify, your business must have experienced either a full or partial suspension of operations due to a government order related to COVID-19, or a significant decline in gross receipts compared to the same quarter in 2019. Additionally, there’s a provision for companies defined as recovery startup businesses.

Subsequent legislation, including the Relief Act, the American Rescue Plan Act (ARPA) of 2021, and the Infrastructure Investment and Jobs Act (IIJA), modified the ERTC, extending its lifespan and altering its terms. Notably, the maximum credit was increased from $5,000 per employee to $7,000 per employee per quarter for most of 2021. However, the credit is no longer available for wages paid after September 30, 2021, under most circumstances.

What companies qualify for the ERC?

If you’re wondering whether your company qualifies for the ERC, there are several key factors to consider. The ERC was created to aid small businesses that experienced a drop in revenue due to the pandemic, but not all companies are eligible. The eligibility criteria are specific and must be met to qualify for the credit.

Your company may qualify if:

- It was fully or partially shut down by a local government order in 2020 or 2021

- Your gross receipts for a single quarter of 2020 fell by 50% compared to the same quarter in 2019

- Your gross receipts for a single quarter of 2021 decreased by 20% versus the same quarter of 2019

- If your company wasn’t operating in 2019, you can use a corresponding quarter in 2020 to demonstrate a revenue reduction between 2020 and 2021.

It’s essential to note that the Infrastructure Investment and Jobs Act (IIJA) brought significant changes, marking the end of the ERC program. However, recovery startup businesses can still claim credit for the third and fourth quarters of 2021. For other employers, it’s crucial to stop applying ERC amounts to payroll after September 2021 and reverse any such credits, which should be paid to the IRS.

Understanding whether your company qualifies for the ERC can provide significant financial relief. Therefore, it’s worth taking the time to assess your eligibility carefully. If in doubt, consider seeking professional advice to ensure you’re not missing out on potential benefits.

Which employees count toward eligibility?

As a business owner, you need to understand which of your employees count toward ERTC eligibility. The size of your company plays a significant role in determining this. If your company has 100 or fewer full-time employees, all employees are considered, regardless of whether they’re providing service during the designated period. This means that even if some of your employees weren’t working due to shutdowns or a decrease in business, they still count towards your eligibility for the ERTC.

However, the rules change for larger businesses. If your company has more than 100 employees, only those full-time employees who are being paid but aren’t providing service due to shutdowns or a reduction in gross receipts are counted. This could potentially limit the amount of credit you can claim if a significant portion of your workforce was still operational during the pandemic.

It’s also important to be aware of the restrictions on claiming the same employees for different credits. If you’re also claiming the Work Opportunity Tax Credit or the employer credit in section 45S for the Family and Medical Leave Act (FMLA), you can’t count the same employee for the ERC credit for the same period. The same applies to the wages; you can’t claim the same wages under ERC and these other credits.

Who does not qualify for the ERC?

Now that we’ve reviewed who counts towards your ERTC eligibility, let’s consider who doesn’t qualify for the credit. The IRS has outlined specific groups that are generally ineligible. This is based on the nature of their business operations, employee status, or other specific circumstances.

Here are the categories of taxpayers and organizations that typically don’t qualify for the Employee Retention Credit:

- Employers who experienced supply chain disruptions but didn’t experience a full or partial suspension of operations by a qualifying order.

- Employers that didn’t pay wages to employees during the qualifying time periods.

- Individual taxpayers who aren’t business owners.

- People who don’t have employees.

- Household employers.

It’s important to recognize that the credit isn’t available to everyone. For instance, if you’re an employer who faced supply chain disruptions but didn’t have a full or partial suspension of operations due to government orders, you’re likely ineligible. Similarly, if you didn’t pay any wages during the qualifying periods, you can’t claim the credit.

The same goes for individual taxpayers who don’t own a business and people who don’t have employees. The credit is designed to reward employers who retained employees during the COVID-19 pandemic, so if you don’t fit that definition, it won’t apply to you. And if you’re a household employer, you’re also on the list of those who can’t claim the credit.

Ensuring you fall within the correct eligibility requirements is crucial to avoid penalties and interest. Always review your specific circumstances carefully to determine your eligibility.

So, Is Your Business Eligible?

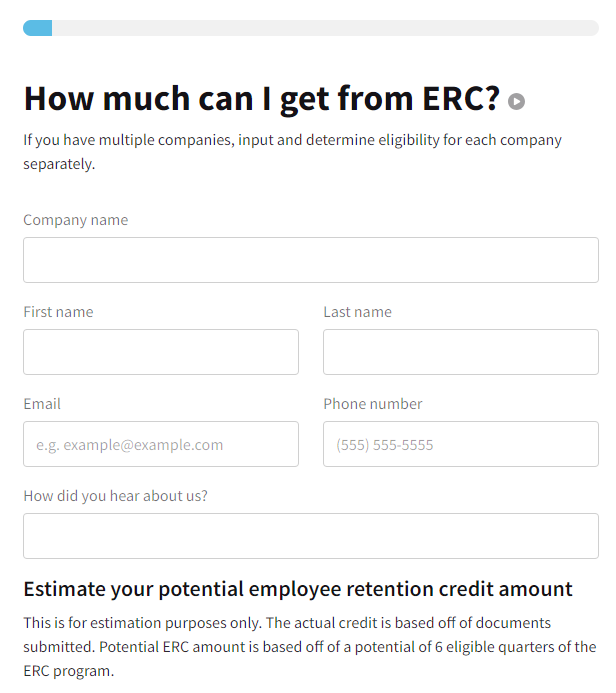

You might be wondering whether your business meets all the necessary criteria for ERTC eligibility. To qualify, your business should have been suspended due to government orders related to COVID-19 during 2020. Additionally, you must have experienced a significant drop in gross receipts. This means either a 50% decline compared to 2019, or an 80% decline for certain organizations like nonprofits and governmental entities.

To calculate this, you should examine your total gross receipts for at least one quarter in 2020 and compare it to the same quarter in 2019. If those numbers indicate a significant decrease, then you’re on the right track toward ERTC eligibility. However, keep in mind that employer contributions towards employee healthcare are excluded from gross receipts calculations.

Another crucial aspect of ERTC eligibility pertains to the credits themselves. They can only be used against the employer portion of Social Security taxes paid throughout 2020. Thus, your business’s tax obligations will play a role in determining eligibility.

Once you’ve assessed your eligibility, the next step is filing for the credit. This is claimed quarterly using IRS Form 941. You’ll need to document your eligibility and any other requirements before filing. Make sure to keep track of key documents, including payroll records and detailed statements of operations.

Conclusion

In conclusion, understanding ERTC eligibility can greatly benefit your business during these trying times.

If your business was impacted by COVID-19 through government orders or significant revenue loss, you may qualify. However, specific criteria apply, including employee count.

With potential savings up to $26,000 per employee, it’s worth exploring.

Always consult with a tax professional to ensure you’re making the most beneficial decisions for your business.