You’re probably wondering about the ERTC deadline, right? Don’t fret, it’s crucial to know when and how to file. We’ve got you covered!

This article provides clear, concise guidelines about filing for both 2020 and 2021 tax years. You’ll find out who’s eligible and tips for a timely submission.

Stay informed and avoid missing that all-important deadline!

Deadline for Filing

It’s crucial to file for the Employee Retention Credit by the designated deadlines to ensure you don’t miss out on this financial relief opportunity. For eligible quarters in 2020, your filing deadline is April 15, 2024. If you’ve retained employees during 2021, mark April 15, 2025 on your calendar as your deadline.

Don’t wait until the last minute. Start gathering necessary documents now. You’ll need accurate employee payroll data and proof of business disruption due to COVID-19. Remember that incomplete or incorrect filings can delay processing or even result in denial of your claim.

Your attention to detail will pay off when it comes to making sure your business receives every dollar it deserves from the ERC program. The more prepared you are, the smoother the process will be.

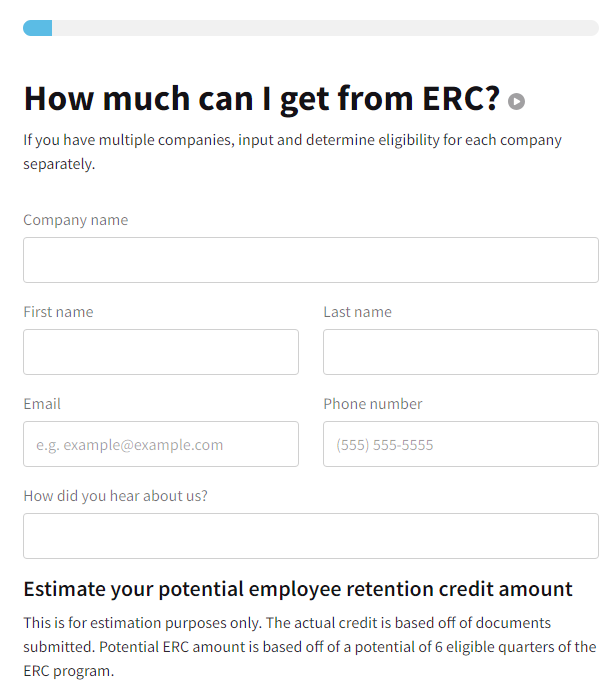

In case you’re unsure about eligibility requirements or how to apply for this credit, consider seeking professional help well before these deadlines approach. Tax professionals can guide you through regulatory complexities and help maximize your benefits.

2020 Tax Year

You’ve got until April 15, 2024 to claim the Employee Retention Credit for the 2020 tax year. This generous timeline offers you an opportunity to recoup some of your expenses during a particularly challenging period. But remember, only three quarters are eligible – Q2, Q3 and Q4. COVID-19 mandates in the U.S didn’t begin until the end of Q1, so it doesn’t count.

Being meticulous about your paperwork is crucial here. Make sure all forms and documents related to employee wages and health care costs during these quarters are organized and at hand. The IRS will need this information when you apply for the credit.

Also, it’s important to note that even if you received Paycheck Protection Program (PPP) funds, you could still be eligible for this credit. There’s a common misconception that PPP recipients can’t claim it – but that’s not true! However, be careful not to double-dip; don’t use the same wages paid with forgiven PPP funds as basis for claiming this credit.

Don’t miss out on this chance to get some financial relief from your 2020 payroll costs. Start gathering your records now. Time flies faster than you think!

2021 Tax Year

For the 2021 tax year, there’s plenty of time to apply for your Employee Retention Credit, with the cutoff date being April 15, 2025. But don’t rest on your laurels; like all things tax-related, it’s best to get started sooner rather than later.

To ensure a smooth application process and increase your chances of approval, here’s what you need to do:

- Gather necessary documentation: This includes payroll records and proof of business disruptions due to COVID-19.

- Apply as soon as possible: The IRS is currently facing a backlog in reviewing applications; getting yours in early increases your chances of timely approval.

- Understand how the credit works: Keep in mind that this is a refundable tax credit against certain employment taxes equal to 70% of qualified wages an employer pays employees after December 31, 2020.

- Consult with a tax professional: They can provide expert guidance tailored to your unique situation.

Eligibility

Let’s delve into the eligibility requirements for the Employee Retention Credit, which hinge on a significant decline in gross receipts and disruption due to COVID-19.

You must demonstrate that your business has experienced a substantial drop in revenue compared to pre-pandemic conditions. The measurement typically uses 2019 data as a benchmark, considering it predates the pandemic.

In assessing a significant decline, you’re not subtracting any costs or expenses from your total revenue. It’s all about gross receipts here. This approach ensures an accurate reflection of how severely your finances have been impacted by the crisis.

Moreover, don’t be misled by rumors suggesting that receiving a Paycheck Protection Program (PPP) loan disqualifies you from this credit. That’s simply not true. Even if you’ve benefited from PPP loans, you’re still eligible for the Employee Retention Credit.

Remember that meeting these eligibility guidelines is crucial if you hope to take advantage of this tax relief measure. So examine your financial data carefully and ensure all criteria are met before proceeding with your application for this valuable credit opportunity designed to aid businesses during these challenging times.

Filing in 2023

Despite the previous deadline, there’s still an opportunity to file for the Employee Retention Credit in 2023. The IRS allows you to amend previously filed forms by submitting a Form 941-X. This way, you can retroactively claim the Employee Retention Credit.

The filing process may seem daunting but understanding these three key points could ease your worries:

- Eligibility: It’s critical that you first ensure your eligibility according to IRS guidelines before proceeding with any paperwork.

- Retroactive Claiming: Even though the original filing date has passed, it’s reassuring to know that you have up to three years after the initial tax filing period to make retroactive claims.

- Use of Form 941-X: You’re not helpless in this process; be empowered knowing that through careful use of Form 941-X, you can correct errors on your quarterly tax return and seek rightful credits.

Tips for Timely Submission

Having deliberated on the importance of filing your ERTC claim in 2023, let’s now focus on how you can ensure a timely submission.

By starting early, you’re not just keeping ahead of the ERTC deadline but also giving yourself ample time to understand the intricacies involved. It’s important to get a firm grasp on the process and seek help if anything seems ambiguous.

Don’t overlook gathering all your necessary documentation ahead of time as it significantly streamlines your filing process. Having accurate records at hand doesn’t only simplify your task but also bolsters your claim against any potential IRS queries.

If the ERTC filing procedure comes across as too complex, don’t hesitate to turn to professional help. Tax experts can provide valuable insights, guiding you through each step ensuring that no mistakes are made and that everything is completed promptly.

Conclusion

Remember, the deadline for filing your 2020 and 2021 ERTC is crucial. Make sure you’re eligible before you file in 2023.

Don’t delay; adhere to all guidelines for a smooth submission process. Knowledge and promptness can prevent unwanted penalties or late fees.

Stay informed, stay timely, and keep up with regulatory changes to maximize your benefits.